The Changing Times in the Semiconductor Industry

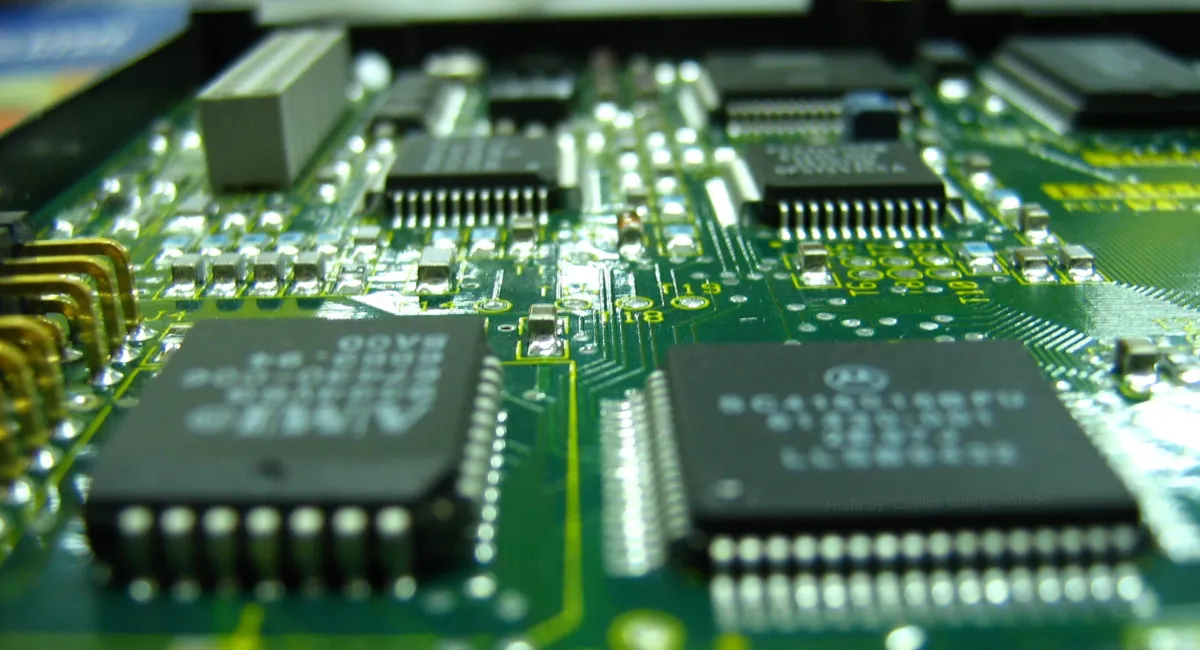

The past few years in the semiconductor industry have been less of a smooth progression and more of a rollercoaster with the safety bar left unlatched. Every time the sector seemed ready to steady itself, another global event knocked it off balance.

COVID-19 was the first major upheaval, flipping demand patterns on their head almost overnight. Currency values spiked, crashed, and spiked again, creating unpredictable pricing across global markets. Supply chains, once optimised to the point of fragility, snapped under pressure, creating parts shortages that rippled through nearly every electronics sector. Research and development projects stalled as resources were redirected, and overall productivity took a measurable global hit.

Just as the industry began to patch up those cracks, the rapid expansion of China’s semiconductor capabilities triggered a wave of restrictions from Western nations. These measures did slow Chinese growth in the short term, but also forced the country to invest in becoming self-sufficient. The unintended consequence? The West lost much of its leverage over the Chinese semiconductor supply chain.

The geopolitical turbulence only intensified when Trump took office. Tariffs were introduced across multiple nations, a move that stirred significant backlash. American consumers were left footing the bill for pricier imports, while many foreign exporters saw their U.S. sales tumble. For an industry as globally interconnected as semiconductors, this policy shift was like tossing a wrench into a finely tuned machine.

The result is an industry constantly reacting rather than planning, pivoting between crises, with each new political or economic shake-up breeding more uncertainty. While semiconductor companies are nothing if not adaptable, the pace and scale of these disruptions suggest the next decade could be just as turbulent as the last.

Trump’s 100% Chip Tariff: A Shockwave for the Semiconductor World

If the semiconductor industry hasn’t already been through enough, Donald Trump’s latest move might be one of the biggest jolts yet. In a meeting with Apple CEO Tim Cook, the president announced plans to slap a 100% tariff on all foreign-made computer chips.

Companies manufacturing chips domestically will dodge the tariff, which is good news for firms like Nvidia and Intel with US facilities, and it’s also comes as no shock that foreign suppliers such as TSMC, Samsung Electronics, and SK Hynix have received exemptions. But for the majority of global chip suppliers, especially those in Southeast Asia, the policy could be devastating. The Philippines (where semiconductors account for 70% of exports), has already sounded the alarm, stating serious concerns over the tariff decision.

The move, according to the US government, is being pitched as a way to drive manufacturing back to US soil. Trump is banking on the idea that if imported chips are too expensive, it will encourage companies to set up shop state-side. This decision is the polar opposite to Biden’s 2022 Chips and Science Act, which offered billions in subsidies, tax breaks, and R&D funding to coax the industry into building locally.

Apple, meanwhile, is putting its money where its mouth is, at least partially. The company pledged $100 billion in new US manufacturing investment over the next four years, bringing its 2025 total commitment to $600 billion. Still, about 90% of iPhones are assembled in China, so this will be a long road.

For consumers, the near-term outcome is pretty clear: higher prices on electronics, appliances, cars, and just about anything with a chip in it. For manufacturers, the calculus becomes a question of short-term pain versus long-term positioning. And for the semiconductor industry as a whole? Yet another chapter of uncertainty in an already chaotic decade.

Will this move help the US become more independent?

Trump’s proposed 100% tariff on foreign-made chips has split opinion right down the middle. To some, it’s economic suicide, and to others, it’s a long-overdue jolt to bring manufacturing back to US soil. The truth is, it’s not the worst idea ever floated, but its execution will make or break it.

For decades, the West has been perfectly happy to offload manufacturing to cheaper labor markets. It’s efficient, it’s profitable, and it’s made life more comfortable for consumers. But it’s also hollowed out the West’s ability to produce the goods it depends on. Meanwhile, the countries we outsourced to didn’t just catch up, they built the skills, infrastructure, and supply chains to surpass us in capability. Now they can make what we can’t, often better and cheaper.

Tariffs are one way to push production back home, but they are anything but a magical switch that can have an immediate effect as soon as its switch on. Modern supply chains are fragile, and slapping a tax this big, this fast, risks doing more damage than good. For example, some components simply aren’t made in the West at all, so taxing them is counterproductive.

Building domestic semiconductor capacity is a multi-year, often multi-decade project, with factories, talent pipelines, and supplier networks requiring massive amounts of effort to establish. If the next administration scraps the tariffs, all that short-term pain could leave nothing behind but higher prices and political fallout.

The goal of independence is sound. The method? Still up for debate.